Celebrating LIFE!!

As usual, heading into the Memorial Day weekend, I stop and reflect a fair amount. Not only for all the veterans and those we’ve lost in wars around the world,

As usual, heading into the Memorial Day weekend, I stop and reflect a fair amount. Not only for all the veterans and those we’ve lost in wars around the world,

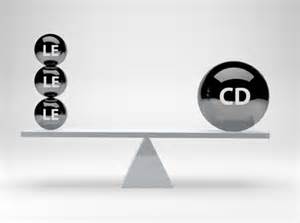

We all know the premise of introducing TRID (Tila Respa Integrated Disclosures) was to benefit the consumer by giving clear and concise forms to disclose accurate fees, and also to

It’s been well over a couple of months since TRID was thrust upon us, and we’re starting to generate a better picture of how lenders are viewing the various requirements,

Here we are at the end of another year in the Three Ringed Circus we call the Mortgage Industry. And, boy, what a ride it was through 2015. I think

Over the last few weeks, as we’ve all become more accustomed to the new required disclosures, and our beloved TRID, but one thing that seems to have slipped under the

Amid all the hype, I have to admit, when I heard originally that the government were changing the old Good Faith Estimate and Truth in Lending disclosures to something new

The attacks in France have truly heated up the debate over “legal immigration”. How could it impact US Housing?

Detroit, Mich. – Feb. 24, 2011 – Based on the incredible unconscionable facts and events you will read below, Quicken Loans will certainly appeal this gross miscarriage of justice as

Lenders user overlays in an attempt to minimize buying back bad loans. Well, the CFPB is looking at overlays as possible redlining. Let us show you the best co-branded marketing

© 2023 MortgageShots | NREPdaily