The Fed Is Paralyzed

The Federal Reserve is holding interest rates steady amid economic uncertainty, forecasting slower growth, higher inflation, and rising unemployment

The Federal Reserve is holding interest rates steady amid economic uncertainty, forecasting slower growth, higher inflation, and rising unemployment

Mortgage rates remain stuck near 7% as the Fed holds steady, doing little to help buyers facing record-high credit card debt and housing unaffordability.

Home prices are poised to drop as inventory rises across the country. Markets like Seattle, Florida, and California are seeing more listings, and just a few low comps can reset pricing for entire neighborhoods.

The housing market has shifted into a true buyer’s market, creating major opportunities for loan officers and real estate agents.

The U.S. housing market is facing a major labor crisis as the number of foreign-born workers—who make up a large portion of the construction workforce

The housing market is stuck in a major slowdown, with new listings at historic lows for the second year in a row. Since sellers are typically buyers too, this drop impacts the entire real estate ecosystem.

The CFPB is reviewing LO compensation rules, sparking speculation about potential rollbacks under Trump.

The U.S. housing market is reaching a breaking point as interest rates remain high, inventory grows, and buyer demand weakens.

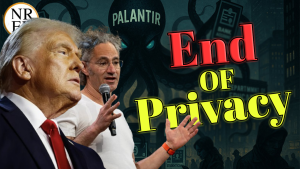

Palantir — the data firm founded by Peter Thiel and linked to Trump — is being tapped to investigate government-backed loans (Fannie, Freddie, HUD) for fraud. With foreclosures rising and the government trying to dodge a new bailout

Palantir — the data firm founded by Peter Thiel and linked to Trump — is being tapped to investigate government-backed loans (Fannie, Freddie, HUD) for fraud. With foreclosures rising and the government trying to dodge a new bailout

© 2025 MortgageShots | NREPdaily