The Coming Storm? Analyzing 2024’s Delinquency Data

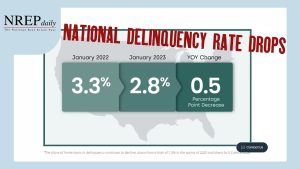

Soaring auto and credit card defaults signal economic risks ahead, despite strong housing market performance.

Soaring auto and credit card defaults signal economic risks ahead, despite strong housing market performance.

As consumer debt continues to climb, lenders may start tightening their lending criteria

The bigwigs at the Federal Reserve are getting antsy. St. Louis Fed President James Bullard is warning us that unless we stop splurging, they’ll slap us with not one, but two more rate hikes!

The credit crunch has become more apparent, with seven large companies filing for Chapter 11 bankruptcy protection in less than 48 hours.

At the time we can least afford it, policy makers are increasing fees on mortgage consumers with good credit. Add this to higher rates, higher prices and higher inflation.

Why Brian Stevens Hates Trended Credit.

New Credit Scoring Seems Ridiculous to us… What about you?

The Most Affected Tax Plan Metro Areas have been laid out by NAR. CLICK HERE to go to their interactive map. CLICK HERE for the Housingwire article.

The Government wants Fannie and Freddie to start allowing alternative credit scores ASAP.

© 2025 MortgageShots | NREPdaily