Real Estate Industry Overhaul: Breaking Down This Week’s Major Changes

In a transformative week for housing, new policies promise easier appraisals and increased affordability, while legal experts question recent industry settlements.

In a transformative week for housing, new policies promise easier appraisals and increased affordability, while legal experts question recent industry settlements.

Navigating the aftermath: Real Estate Industry seeks FHFA’s help post-lawsuit.

https://www.communitylender.org SCOTT OLSON EXECUTIVE DIRECTOR Scott has over 20 years experience working on Capitol Hill, 15 of which he served on the House Financial Services Committee, where he held a

Get off the sideline and into the game. Learn NonQM products and how to sell them – Become an Expert. Click HERE to schedule individual or group training today.

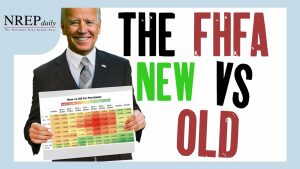

Courtesy of the FHFA, new credit score models are on the way. The said updates will be made through increased accuracy, innovation and inclusion. What could go wrong?

Enter the Federal Housing Finance Agency (FHFA) and their pilot program that grants waivers on title insurance requirements for loans sold to Fannie Mae.

The FHFA continues the insanity by subsidizing bad credit high loan to value borrowers by increasing fees on those with better credit and higher down payments. Crazy.

At the time we can least afford it, policy makers are increasing fees on mortgage consumers with good credit. Add this to higher rates, higher prices and higher inflation.

Have questions about how to get your borrower approved? At Oaktree, we’ve built our business around understanding what you need and what’s important for your borrowers. That’s why we offer

© 2025 MortgageShots | NREPdaily