Buyers Are Backing Out Like Crazy

Suzanne shares how she’s handling a tough housing market where 20% of real estate deals are falling apart.

Suzanne shares how she’s handling a tough housing market where 20% of real estate deals are falling apart.

Right now, 82% of Americans live in areas facing an economic downturn the highest level since 2020. While that points to a possible recession, it could actually bring opportunity for the housing market as rates, prices, and competition ease.

interview with top Keller Williams agent Carrie Nalan about what realtors really want from loan officers.

interview with top Keller Williams agent Carrie Nalan about what realtors really want from loan officers.

Chase CEO Jamie Dimon recently cautioned that rising auto loan defaults and a wave of bankruptcies in the auto industry could signal deeper economic issues.

Chase CEO Jamie Dimon recently cautioned that rising auto loan defaults and a wave of bankruptcies in the auto industry could signal deeper economic issues.

Brian Stevens interviews Loan Factory founder Thuan Nguyen, one of the nation’s top-producing loan officers

breaking down key data showing that the housing and financial markets are changing fast.

Mortgage expert Brian Stevens breaks down today’s housing and market trends explaining how young buyers are putting their money into the stock market instead of homes, why 15% of real estate contracts are falling through, and how refinance demand has surged 81% thanks to lower rates around 6.37%.

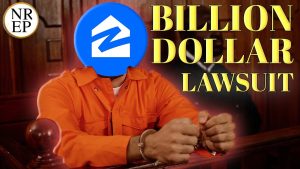

Zillow is under fire with four major lawsuits, including a $1 billion copyright suit from CoStar, an FTC case over alleged $100 million anti-competitive payments to Redfin, and class action and antitrust claims tied to hidden fees and private listing bans.

© 2025 MortgageShots | NREPdaily